More IRS Notices Going Out

IRS computer efforts to match income reported on 1099s are resulting in more IRS Notices to taxpayers: Don’t Ignore It!

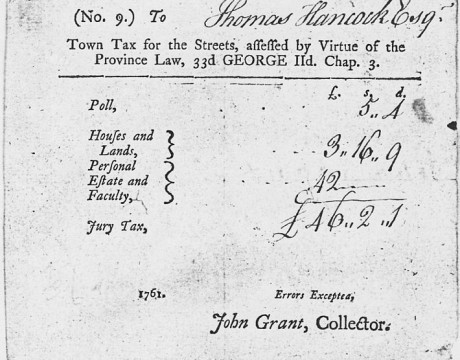

How Long Should You Keep Tax Records?

Before you throw out those old receipts, there are some cases where your tax return status may demand you keep those records indefinitely. An advisory guide from the So.MD CPA firm Burroughs, Moreland & Mudd.

Nearly Time to File an Extension

Tax Day is just about here; if you’re not going to be ready, this is the right time to let the IRS know about it, reminds Burroughs, Moreland & Mudd CPAs.

Significant Changes to Tax Law Re: Tangible Property

Tax experts Burroughs, Moreland & Mudd can help your business through the new “repaired” regulations affecting tax impacts on tangible property.

Protect Your Assets Against Summer Storms

You have a plan for your family, but will your important documents and valuables be safe in a storm? Find out how to make sure they are.

Plan Ahead for Next Year’s Tax Day

Changes in tax law may affect you next year. Burroughs, Moreland & Mudd, CPA, PA, can help you understand these changes and prepare for next year!

File a Form Now to Extend Your Tax Deadline

Can’t make the April 15 tax filing deadline? You can get an automatic six month extension of time to file from the IRS.

Don’t Get Hooked by Tax Time Phishing Scams

The IRS does not contact taxpayers by email, text or social media to request personal information.

Eight Tips for Claiming Charitable Deductions

If you’ve been generous, you deserve tax deductions. Just be sure to follow these tips from Burroughs, Moreland & Mudd.

You Can Shave More Off Taxes Than You Think

The tax law is complex, so here are some deductions you may have overlooked.